This article is part of the Futures in Long-termism series. You can read all other related blogs by following the links at the bottom of the text.

The form of the limited liability company (LLC) originated during the Roman Empire, with the legal structure of the slave-run company. Two partners allocated certain assets to a business that was owned by a slave. The partners’ liability for any losses was limited to those assets. Today, corporate governance practices are linked even more tightly with maximising shareholder protection by developing a meshwork of contracts that shield assets and shift losses to creditors, perpetuating negligent short-term decision-making. Dissociating risk from rewards, has resulted in dissociating companies from their context. The concept of Entangled Organisations attempts to reverse this effect; searching for an evolution of the corporate form that is enmeshed in localities promoting long-term sustainable conduct.

The rise of the LLC is a story of taxpayer ingenuity, adept political lobbying and entrepreneurial innovation that promised the best of two worlds—the limited liability of corporations and the favorable tax treatment of partnerships.

As Katharina Pistor argues in her book The Code of Capital, the LLC owes its success to three elements: Entity-shielding, loss-shifting and the prospect of immortality. The first of these creates distinct asset pools with distinct creditors; if one pool fails the others are not affected. The second aspect allows shareholders to limit their own losses by shifting the risk of doing business to others, even to the public at large. The third element points to the fact that corporations can only dissolve in a bankruptcy by the voluntary act of shareholders.

Through these three elements, the risks created by the LLC have been dissociated from their reward structures, creating an important problem—what economists call the phenomenon of moral hazard—the notion that negligence, mismanagement, and fraudulent behavior become more likely when decision-makers aren’t liable for their actions. Company managers are confident about taking gambles because they reap the rewards of success (through bonus checks) but can pass the harms of failure to others.

Another element that amplifies the recklessness of the LLC is the abstraction of money. Monetary values are the main metrics for the success of an LLC—but such abstracted systems discount huge amounts of embedded value, leaving stakeholders absorbing the risk. For example, forests only become legible to companies through their timber value, but extended values to other stakeholders (e.g. local populations or animals) cannot be accounted for or represented through monetary metrics. This becomes apparent in current price signals that do not reflect the need to conserve forests for long-term sustainability. As a result, the more mono-dimensional and abstract, or focused on money, the system becomes, the less capable it’s dealing with local volatilities. For proof of this, look no further than the bush fires blazing across Australia.

At the same time, we’re observing corporate longevity decreasing. The average life expectancy of Fortune 500 companies has decreased from 75 to 15 years in the last 50 years. Companies are becoming discontinuous, with little meaningful investment towards employees and other stakeholders, ripping benefits—the latest CEO-to-worker pay ratio recorded in the US was 321:1—and being negligible to any long-term planning and impact—deaths related to stress, toxic workplaces and bad management practices are on the rise.

How could we start re-designing the rules and systems of incorporation coded in capital, to embed a multiplicity of stakeholders and build corporates that act in the long-term interests of societies?

Experimental probe: Entangled cooperation

Recently, Business Roundtable published a statement on the Purpose of a Corporation, signed by 181 CEOs, commiting to lead their companies for the benefit of all stakeholders, moving away from shareholder primacy. However, the short-term practices of the limited liability company will not be halted by a signed commitment. Do we need to invent a new form of Entangled Cooperation, where all stakeholders—governments, citizens, animals, landscapes—are enfranchised within corporate governance to achieve better liability and risk distribution?

The blueprint for an alternative to the limited liability company has existed for a thousand years—the commenda. First introduced in the port cities of 11th century Italy, the commenda is a hybrid legal form in which managers are personally liable for all debt and losses, but investors are only exposed to the extent of their investment. The hallmark of the commenda is that it corrects incentive asymmetries by linking decision-making with risk exposure.

Today, there are several alternatives to the LLC that attempt to develop different governance philosophies, by carefully examining the environment they operate in. The B-Corp, for example, is a social enterprise that creates value for non-shareholding stakeholders such as employees, local communities and the environment, incorporating the interests of all stakeholders into the fiduciary duties of directors and officers. Another type of legal structure is the Distributed Cooperative Organization (DisCo) Governance model, which allows workers to mutualize their skills while identifying value flows, making care work visible and creating plurilingual commons.

New innovative contracts could negotiate between multiple interests and values, to establish sustainable business models that are not predicated on exhaustion and excessive risk-taking. Through blockchain technology, humans, non-humans and other kinds of stakeholders could self-represent their respective interests by entering into associations through a series of smart contracts. A simple example of such an application is Terra 0 built on the Ethereum network and creating technologically-augmented trees, able to act within a predetermined set of rules in the economic sphere as agents in their own right to protect their survival. Developing further the intentions of Terra 0, we can imagine capturing the interests of multiple forest stakeholders, such as insects. As a result the extractive actions of logging companies could be limited by protecting the interests of insects or other stakeholders whose livelihoods depend on the forest, tightly linking the company’s practices with ground conditions. Such terms of restriction, driven by non-economic parameters is a first step in establishing Machine Entangled Cooperation that acts both locally and globally.

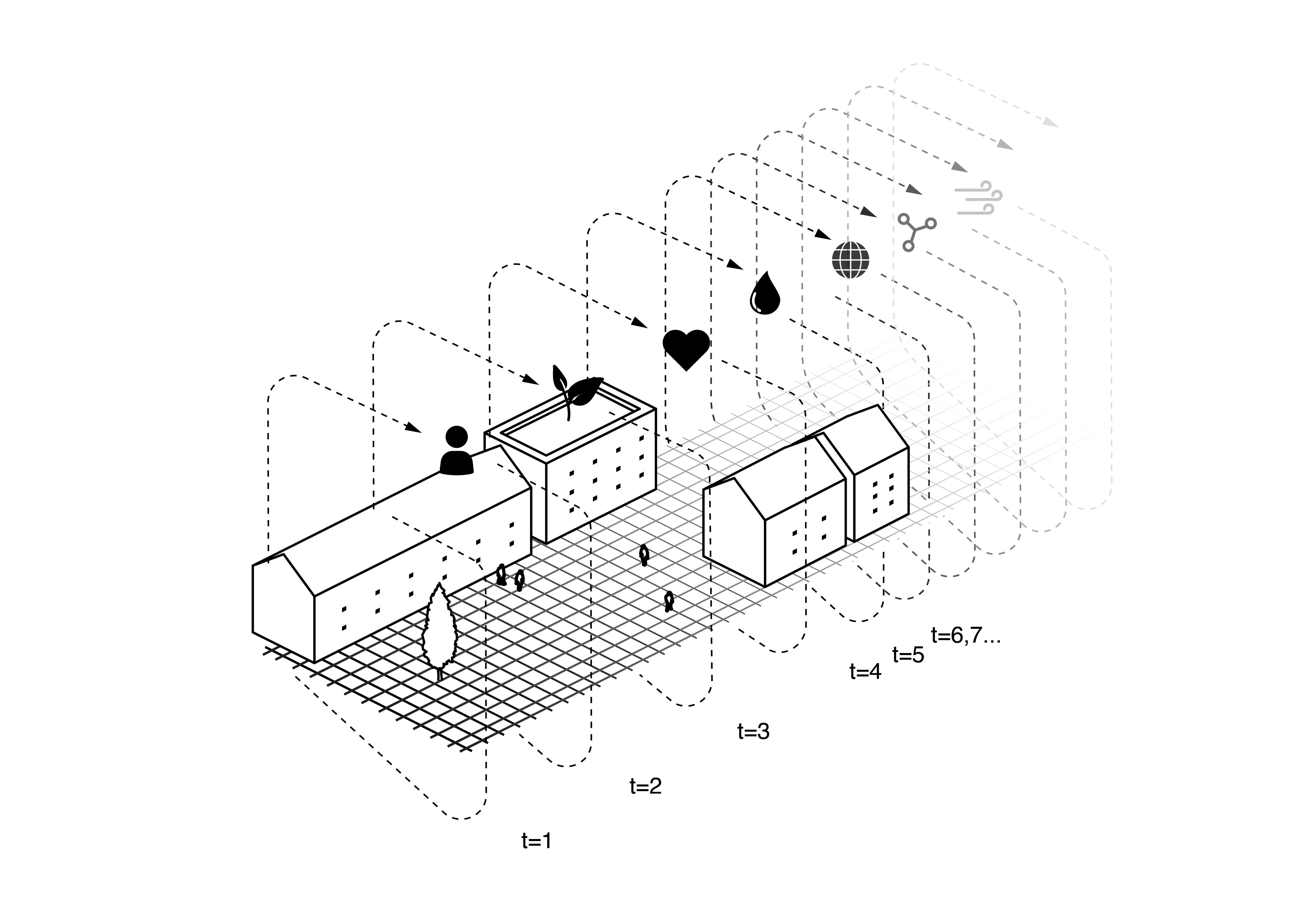

We need to develop a new conception for a social contract between business, society and non-humans rooted in a shared set of values and aspirations that are appropriate for the 21st century, and according to long-term goals of a renewed economic system. As Paul DiMaggio argued new institutions arise when organised actors with sufficient resources see in them an opportunity to realise interests that they value highly. It seems that now is the time to experiment to discover new cooperation structures. Following this reasoning, we will explore what the legal incorporation of a truly embedded corporation could look like. What are its transactional and HR structures, and what are its trade and transfer protocols? And ultimately what is the contract between business and society?

This is one of another six interdependent experimental zones and probes we’re investigating as part of our work on Futures in Long-termism.

You can read more here:

1. Perishable Selves to Persistent Selves

2. Obsolete Objects to Persistent Things

3. Abstracted to Entangled Organisations

4. Shrinking State Care to Long Welfare

5. Short-term Investments to Long Financing in a volatile world

6. Limited Representative Democracies to Long Democracies

These pieces have been co-authored by Chloe Treger, Indy Johar and Konstantina Koulouri. The visuals were developed by Juhee Hahm and Hyojeong Lee.

This portfolio of experimental probes is part of broader system of interventions being prototyped by the Long Term Alliance.

The Long Term Alliance is co-founded by EIT Climate KIC, Dark Matter and a cohort of partners focused on five Areas of Action, which when combined seek to leverage systemic impact—changing behaviour, mindsets and action towards a long-term oriented society.

Our five Areas of Action are: Resetting the Rules of the Game for Regulation and Governance; Rethinking Notions of Value to Reform the Financial System; Empowering Individuals through Information Transparency, Capability Building & Behaviour Change; Enabling Collective Action & Creating New Democratic Spaces to Create the Ground Swell Pressure for Change; and Shifting Culture & Narratives to Promote Long-Term Mindsets.

In parallel and in recognition of the scale of change necessary, EIT Climate KIC together with Dark Matter and our partners are also experimenting with new instruments, mechanisms and vehicles that can invest over longer time frames, invest in the institutional deep code experimentation necessary, invest vertically in portfolios spanning deep culture change to new institutional infrastructures to accelerate the transition of Europe towards a long-term society.