Climate KIC supported crop insurance project acquired by world’s largest re-insurer

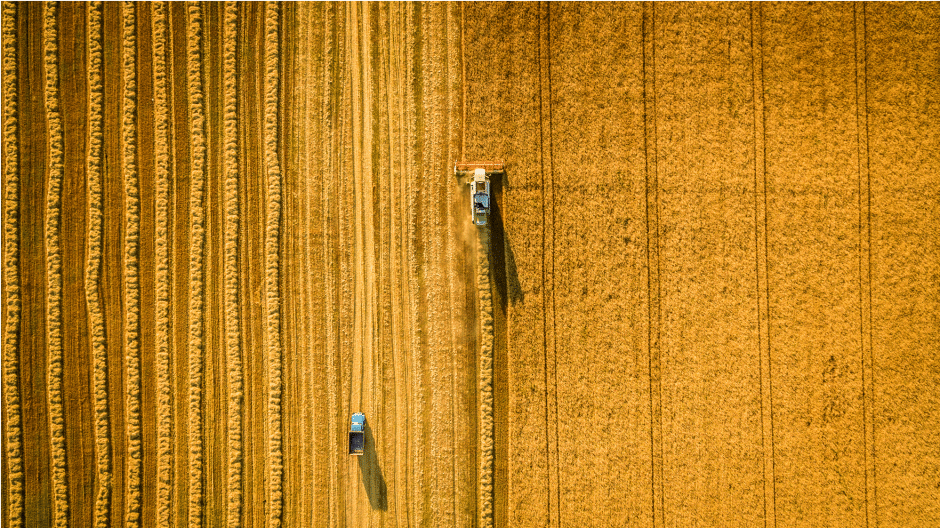

The insurance sector is well aware of the rising threats of climate change. In particular, crop insurance—i.e. securing of revenues for a farmer even if crops fail—is likely to undergo substantial shifts in design, premiums and covered risks.

Crop insurance solutions are addressed by the IPCC, G7 and G20 leaders as well as at the last COPs as important tools in order to increase resilience to climate change and altered weather perils especially in least developed and developing countries. However, widespread implementation of such insurance schemes is hindered by uncertain and unreliable assessments of crop yield losses.

To cope with these challenges, insurance companies seek collaboration with research institutes to better understand looming risks. The working group “Adaptation in Agricultural Systems,” led by Dr. Christoph Gornott at the Potsdam Institute for Climate Impact Research (PIK), has now acquired a new project funded by the Munich RE, the world’s largest re-insurer.

The project is operated jointly with the GAF AG in Munich, a leading company in Remote Sensing applications. The common aim of the project is to improve crop yield estimations for wheat and rice to calculate production risks for farmers in India. A scaling up of the approach from the Indian case study is also foreseen, using scalable crop models.

The envisaged results could advance research in unravelling crop perils and support food security by a better understanding of crop insurances and their potential benefits. Crop insurance is considered as a means to escape the poverty trap when low harvests do not delay necessary investments as the loss of revenue is covered by the insurance.

This successful acquiring of the funding is a result of work conducted through the ‘AgRATi India’ project, which was funded by Climate KIC and carried out by a team of 12 members at PIK. Through the AgRATi project, the team developed the AMPLIFY crop yield loss assessment tool, which is able to better estimate expected yield losses in staple crops. Such estimation allows, among others, for improved design of harvest loss insurances and thus the adaptation of loss-mitigating techniques by farmers. The uniqueness of AMPLIFY is its high accuracy in detecting observed losses, its simple implementation and rapid adaptation to new environments. The financial viability of AMPLIFY was as evidenced by its purchase by a large re-insurance company, Munich RE, in 2018.