Redesigning venture capital (part II): A blueprint

This article is part of the “Redesigning venture capital” series. Read part I (“The challenge”) here.

In a recent article, I argued that the traditional venture capital model is severely limited in its ability to leverage the power of entrepreneurship to address complex societal challenges. In this follow-up essay, I present the contours of an alternative approach that will serve as the basis for bringing systemic thinking to entrepreneurial finance.

The challenge

Let’s start with a short recap.

As I contend in part I of this series, traditional venture capital firms operate under paradigms, structures and mechanisms that create optionality of an incremental—not transformative—nature. In other words, VCs favour systems optimisation, not systems change.

My main argument is that the Discounted Cash Flow method—which is widely used in the venture capital industry as a decision-making framework or at least as a mental model to assess the risk and return characteristics of a start-up—constricts the definition of value, enforces market conformance, imposes arbitrary timelines, reduces business model choice, encourages predatory business behavior and raises unreasonable return expectations.

I also describe how cookie-cutter investment approaches—e.g. GP/LP fund structures with seven to 10-year lifespans—limit the diversity of financing instruments to a single, predominant form: Cash investments in exchange for some equity-like preferential ownership rights in a limited liability company. (NB: I have written about the issues around LLCs here).

Others have recently taken similar positions. Alex Basu and Per Anell of Industriefonden blame the behavior of VC firms for technology stagnation, Nathan Schneider of the University of Colorado Boulder advocates for new exit routes, and the founders of Zebras Unite have set out to develop a venture capital model capable of funding profit and meaning. Clearly, I’m not the only one who believes venture capital is in need of an overhaul.

So how can we better leverage entrepreneurship as an innovation practice to address those societal challenges that require structural, systemic change?

New words, please!

This journey starts with recomposing the language of investing. Our words shape culture and identity. They invite and exclude, define and restrict. They create biases and anchors and set priorities and expectations.

Words like start-up, money multiple, elevator pitch, growth model and exit belong to an outdated industrial vocabulary. They suggest that all problems are complicated in nature and can be overcome with smart engineering and shrewd management. They imply that the pathway to value lies in spending big and growing fast.

This language feels inappropriate for tackling complex societal challenges. I suggest we substitute start-up for entrepreneurial initiative—not as catchy, perhaps, but more spacious and tolerant; and that we change venture capital for financial support—vaguer, sure, but better encapsulating the idea that investment capital is primarily meant to help entrepreneurs, not multiply itself. Let’s replace revenue model with value model, customer with beneficiary, and product with solution. Let’s also speak more about collaborators than about competitors, and more about systems than about markets.

The design space

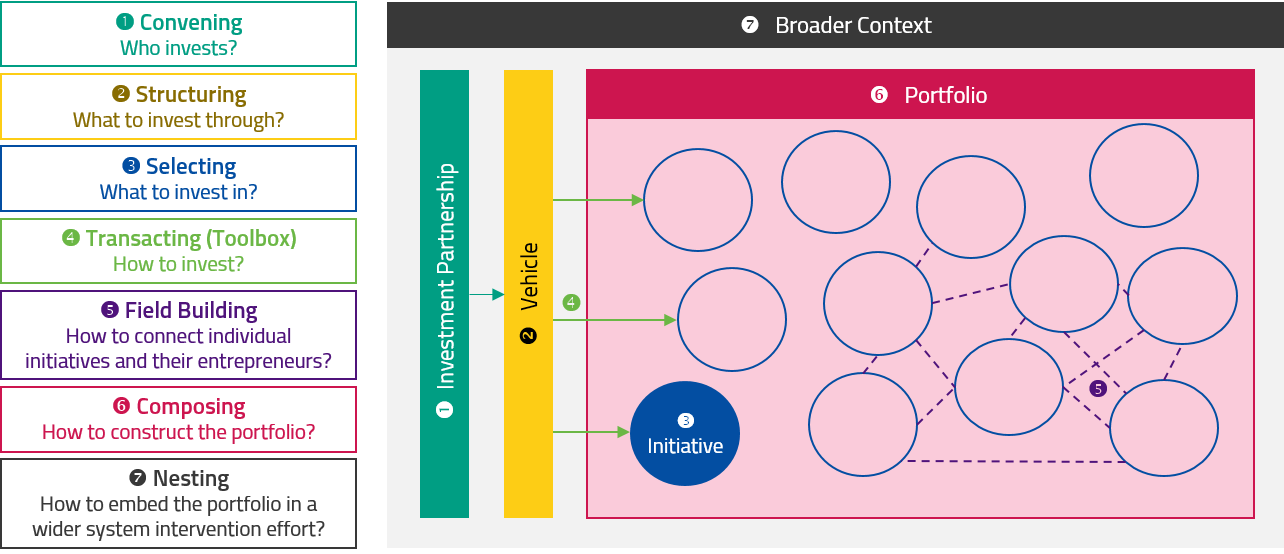

I believe that any investment programme will generate its impact through the choices made in different domains of a design space. This space is shaped by a set of fundamental questions that designers must address:

Who should be part of the investment partnership? Which vehicle is best suited to host the programme? What type of entrepreneurial initiatives should be supported? How should financial support be provided? And how can we make the whole greater than the sum of its parts through deliberate portfolio composition, field building, and nesting within a broader systems intervention approach?

Collectively, these choices combine to form not only an investment strategy but also an investment culture, mindset, and community.

At Climate KIC, our ambition is to make these choices in a way that creates an entirely new asset class: The transformative entrepreneurial finance programme (TEFP). Not the stickiest of names, I admit, but let’s worry about branding and acronyms later.

Here is what a TEFP (pronounced: teffpy) looks and feels like:

1 — Investment partnership

A TEFP convenes people who align behind the shared intent of systems change. Intent matters because what investors set as their priorities determines what they care about. Systemic investors will interrogate the universe of investable assets with different frameworks, using different metrics to evaluate potential, success, and failure. They will also bring a different mindset to their investment practice, embracing collaboration, community, inclusion and humility over competition, tribalism, exclusion and ego. Such a partnership will feel friendly, lighthearted, hopeful, creative, ambitious and empathetic.

2 — Vehicle

A TEFP favors a legal and operational umbrella that offers a large degree of flexibility with respect to financing instruments, time horizons, accountability frameworks, and the blending of different types of capital. Following the fractality principle, these considerations apply both to the vehicle that hosts the programme as well as to the legal wrappers around individual entrepreneurial initiatives.

3 — Selection framework

At the level of the investee, a TEFP selects entrepreneurial initiatives that have the potential to generate system-transformative outcomes. More on this below.

4 — Toolbox

A TEFP engages a diverse range of financial mechanisms to maximise an entrepreneurial initiative’s systemic impact potential. It carefully matches these instruments to the needs of the initiative (‘smart investing’), often deploying multiple instruments at once and replacing them over time as the nature of the initiative’s risk profile evolves.

Instruments in the toolbox include revenue-sharing agreements, outcome-based financing, convertible debt, collateralized loans, preferred and common stock, carbon credits, and asset tokenisation through blockchain, among others.

5 — Field building

Within a portfolio, a TEFP offers an opportunity to unlock combinatorial effects by selecting individual assets not just based on their inherent merits (‘single-asset paradigm’) but based on how they strengthen the portfolio overall. Combinatorial effects can occur when multiple assets intervene in adjacent parts of a system and/or act synergistically with one another. They can emerge spontaneously or be generated through, for instance, participation in an initiative’s governance.

6 — Portfolio composition

At the level of the portfolio at large, a TEFP stipulates a set of composition principles that have ramifications for the risk, return and impact profile of the investment programme. These include aspects such as the number of positions, intended time-to-exit, preferred exit routes, investment phasing and investee sourcing strategy.

These elements also affect the amount and quality of intelligence that can be extracted from the portfolio as a whole. In contrast to traditional venture capital, where portfolio-level considerations are usually neglected or reduced to risk aspects, a TEFP considers portfolio composition principles as an endogenous driver of impact.

7 — Nesting

With respect to the wider context in which the investment programme operates, individual entrepreneurial initiatives can be linked to a broader systems intervention approach—for instance, Climate KIC’s Deep Demonstration programmes, which are portfolios of innovation experiments intending to demonstrate alternative futures for specific systemic contexts.

Developing a selection framework

While all of the above levels matter, a TEFP’s systems change potential will stem mostly from the entrepreneurial initiatives it backs. So what selection framework do we use to identify activities that have system-transformative potential? In other words, how do we argue what’s in and what’s out?

Frankly, I don’t know yet.

In search of guidance

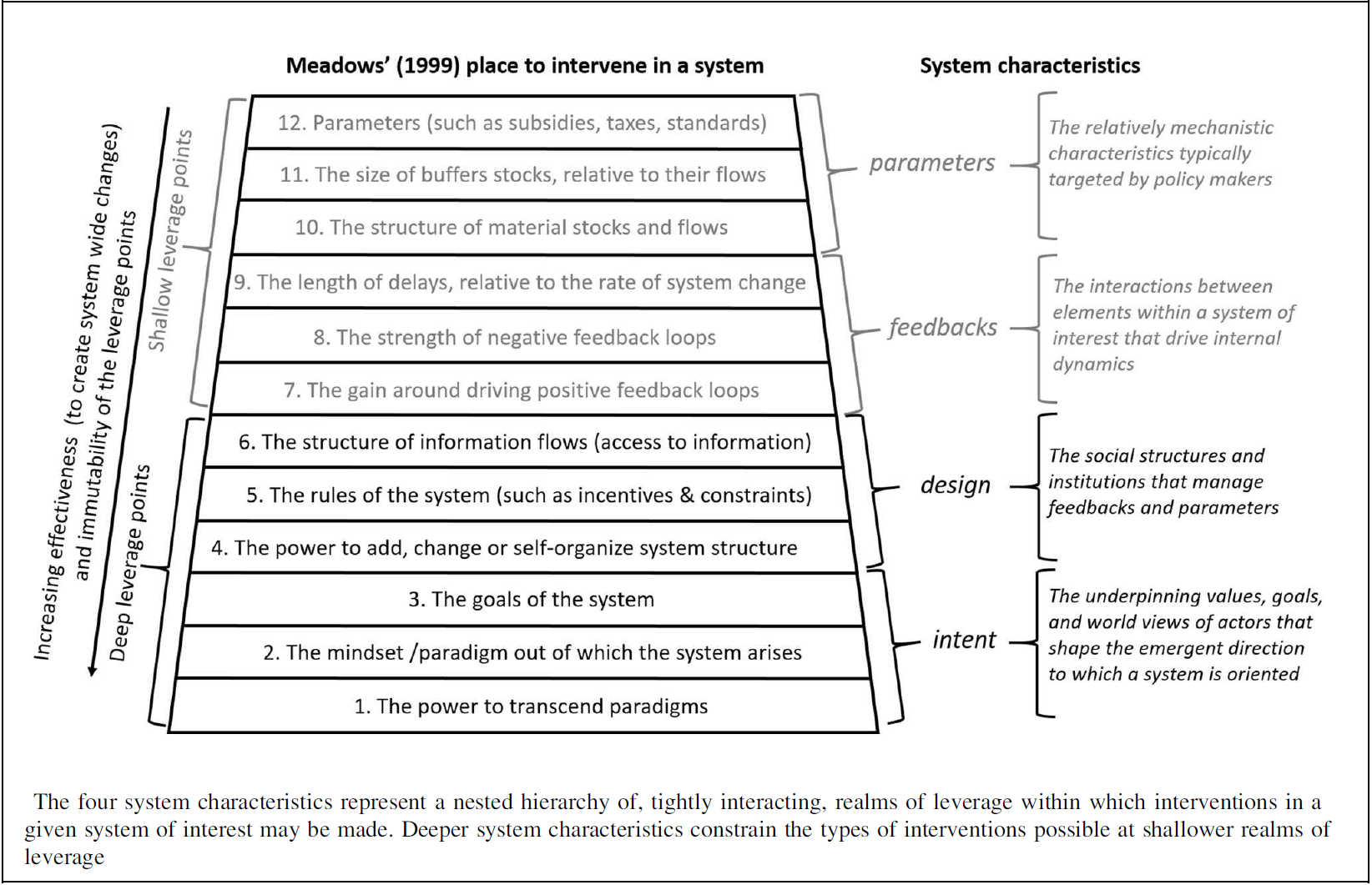

My quest for such a framework first took me to the concepts proposed by researchers in the domains of systems thinking and sustainability transitions. Donella Meadows’ concept of leverage points—both its original version and especially its adaptation by researchers at Leuphana University—seemed a natural starting point. Yet when I tried to map a set of entrepreneurial initiatives onto it, the results felt too arbitrary.

Other frameworks seemed too outcome-focused, backward-looking or theoretical—Johan Schot’s deep transitions, Carlota Perez’ techno-economic paradigms, Frank Geel’s multi-level perspective on socio-technical transitions, TIPC’s processes of transformation, Oxford-INET’s sensitive intervention points, Elinor Ostrom’s typology of social-ecological systems, and Raymond Ison’s cybersystemics.

The challenge is that such a framework must not only provide the basis for developing a theory of change that articulates why an entrepreneurial initiative is potentially system-transformative (as opposed to system-optimising). But it must also be able to provide selection guidance on an ex-ante basis and to inform our understanding of the directionality of an initiative’s intended impact. These are highly practical purposes that the above frameworks fail to serve.

My hunch is that we are more likely to be inspired by social innovation and design communities. Design is an inherently forward-looking, action-oriented, and user-centric practice. Designers are good at synthesis, reflexivity, and creation. Terry Irwin’s transition design framework or the design to shift model by ALT/Now embody some intriguing ideas.

All that being said, I believe that no existing framework will likely serve the purpose of a TEFP. So I suggest we develop one, following a bottom-up approach based on the discursive assessment of different entrepreneurial initiatives. By arguing for or against a potential investee through a structured process, patterns will emerge that can be weaved into a coherent selection framework that is fit for purpose.

Applying the selection framework in practice

Irrespective of what emerges from this process, there are a number of principles I see as important for the use of such a selection framework in practice:

- The framework must not become a prison of thought and action. The investment partnership must resist unhelpful categorisation and instead hold the framework loosely. The framework should inspire, inform, and guide a conversation, not make a decision on behalf of its users

- The investment partnership shouldn’t try to quantify the impact potential. Such ex-ante calculations will only lead to pseudo-scientific results. A theory of change, together with an articulation of the impact pathway of an initiative, will provide a sufficient basis for selection

- The investment partnership should be mindful of the biases—on geography, gender, tangibility, simplicity—the selection framework might introduce or reinforce. These biases must be surfaced and mitigated

- The selection framework must structurally connect into the learning protocols of the TEFP so that it can be evolved over time

Finally, as in any deliberate system intervention, there will be a need to safeguard the benign directionality of an entrepreneurial initiative. All systems interventions run the risk of creating unintended consequences. Sometimes, this risk is mitigated through the very nature of the initiative or the way it is designed or executed. In other situations, it will be important to attach covenants that control for unwanted mission drift to the financial mechanisms used in an investment.

What about financial returns?

These play an important role, too, as a TEFP is not a granting programme. But instead of using the arbitrary rules of thumb of today’s venture capital industry—a 10x exit multiple per investment to achieve a 20–30 per cent IRR for the portfolio as a whole—each investment partnership needs to decide what level of financial return it deems appropriate and how it intends to assess an initiative’s fROI potential on an ex-ante basis.

Way forward

Our next step is to convene a group of system thinkers, entrepreneurs, investors and creative minds to develop a first articulation of the selection framework and other elements of a TEFP. Our near-term ambition is to launch the first edition of a TEFP later in 2020 to support the most promising entrepreneurial initiatives in Climate KIC’s portfolio.

Our long-term vision is to inspire and enable a whole new breed of investment programs managed by us and others, creating a new asset class fit for addressing the most tangible and pressing issues of the 21st century.